CONTACT US

Cobalt is an important metal resource. Due to its unique physical and chemical properties, it is widely used in many high-tech fields. With the continuous growth of global demand for high-performance materials, the strategic position of cobalt resources is becoming increasingly prominent. A thorough understanding of the mining, smelting and downstream application industrial chain of cobalt is conducive to grasping its development trends in modern industry and emerging technologies, and promoting the rational utilization and sustainable development of resources.

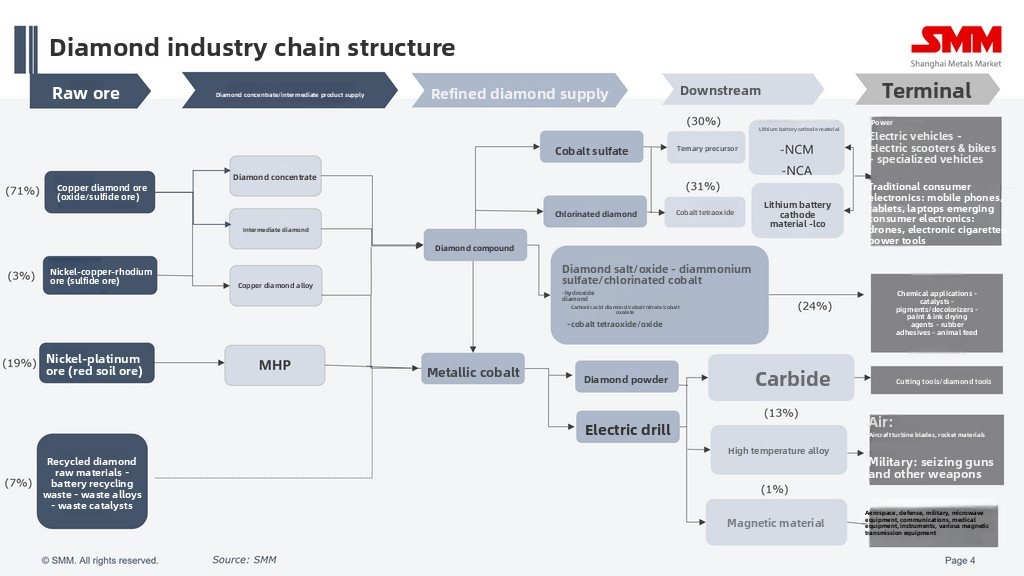

The cobalt industry chain is divided into the upstream mining end, the midstream smelting end and the downstream consumption end.

I. Upstream Supply Market Structure

The global distribution of cobalt resources is highly concentrated. According to the statistics of the United States Geological Survey (USGS), the global proven reserves of cobalt ore amount to 11 million tons. The distribution of cobalt resources is extremely uneven, with countries such as the Democratic Republic of the Congo and Australia being the regions most rich in resources.

China's cobalt resources mainly come from associated ores, which usually coexist with copper, nickel and iron ore.

At present, there are 150 known cobalt ore deposits across the country, distributed in 24 provinces (autonomous regions).

The grade of cobalt ore in China is relatively low, and cobalt is mainly recycled as a by-product. Due to low recovery rates, complex processes and high production costs, China still largely relies on imports for cobalt resources.

According to SMM's assessment, 71% of the world's cobalt raw materials will come from copper-cobalt mines in 2024. At present, there are mainly three sources of cobalt: cobalt mines, recycling and other channels.

By 2024, 90% of cobalt will come from primary cobalt mines, with recycling and other sources accounting for 7% and 3% respectively.

Cobalt mines are mainly concentrated in regions such as the Democratic Republic of the Congo, Australia and Indonesia. Due to the geopolitical issues existing in the Democratic Republic of the Congo, there are certain restrictions on the export of raw ore. Generally, it reaches Chinese ports in the form of cobalt intermediates (i.e., crude cobalt hydroxide, with a cobalt content of about 30%).

Due to the significant pollution caused by pyrometallurgical processes, hydrometallurgical smelting is mainly adopted, resulting in more cobalt intermediates than copper-cobalt alloys.

In addition, recycled raw materials (such as battery recycling, alloy waste, etc.) are also part of the supply of cobalt raw materials.

The leading cobalt mining enterprises at present mainly include Luoyang Luanchuan Molybdenum Industry Group Co., LTD., Glencore of Switzerland, Eurasian Natural Resources Company and China Nonferrous Metal Mining Group. The market share of large cobalt mining companies has been continuously rising. The situation where China Molybdenum and Glencore are neck and neck and competing for the lead has made the situation where a single mining company controlled the cobalt price a thing of the past.

II. Overview of Midstream Smelting Situation

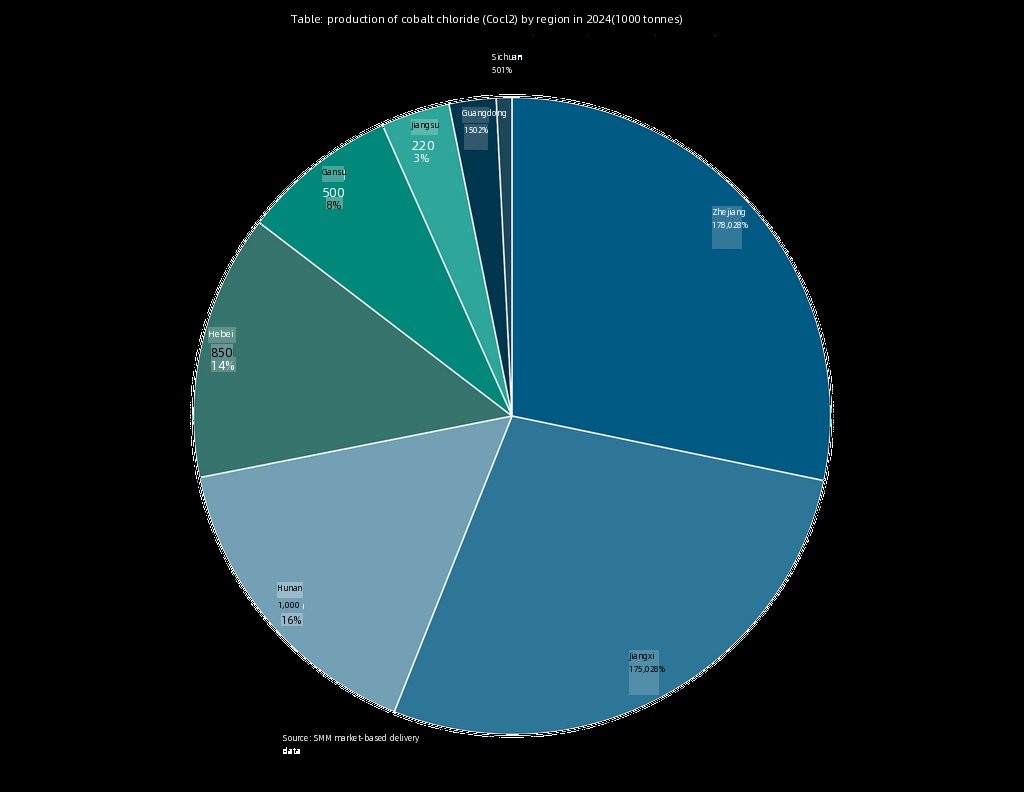

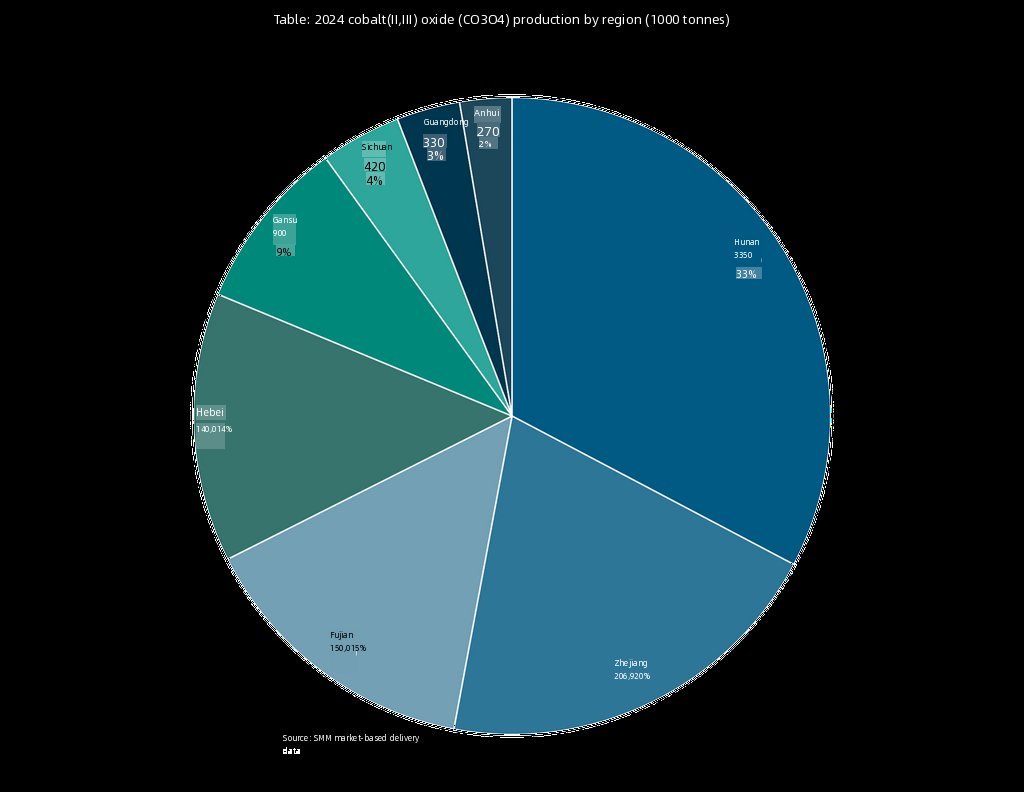

In terms of refined cobalt supply, it is mainly divided into metallic cobalt and cobalt compounds. Metallic cobalt is mainly divided into cobalt powder and electrolytic cobalt. Cobalt powder is mainly used in cemented carbide, while electrolytic cobalt is mainly used in superalloys, cemented carbide and magnetic materials. Cobalt compounds are mainly divided into cobalt sulfate and cobalt chloride. Cobalt sulfate is mainly used in ternary precursors, while cobalt chloride is mainly used in cobalt trioxide. Both are important components of lithium battery cathode materials. There are also some cobalt carbonate, cobalt nitrate, cobalt oxalate and cobalt hydroxide.

Cobalt salts are chemical compounds of cobalt. Common cobalt salt products include cobalt sulfate, cobalt chloride, cobalt nitrate, cobalt acetate, cobalt carbonate and cobalt oxide, etc. Among them, cobalt sulfate (CoSO₄) is currently the most widely used cobalt salt, mainly used in the manufacturing of ternary precursors for lithium battery cathode materials NCM and NCA, and ultimately serves power vehicles, power two-wheelers and special-purpose vehicles. Cobalt chloride (CoCl₂) is commonly found in the consumer sector. Traditional consumer sectors include mobile phones, pads, and laptops, while emerging consumer sectors include drones, e-cigarettes, and power tools. Cobalt carbonate (CoCO₃), cobalt nitrate (Co(NO₃)₂), and cobalt oxalate (CoC₂O₄) are mainly used in chemical applications, such as catalysts, pigments/decolorizing agents, drying agents for paints and inks, rubber adhesives, animal feed, etc.

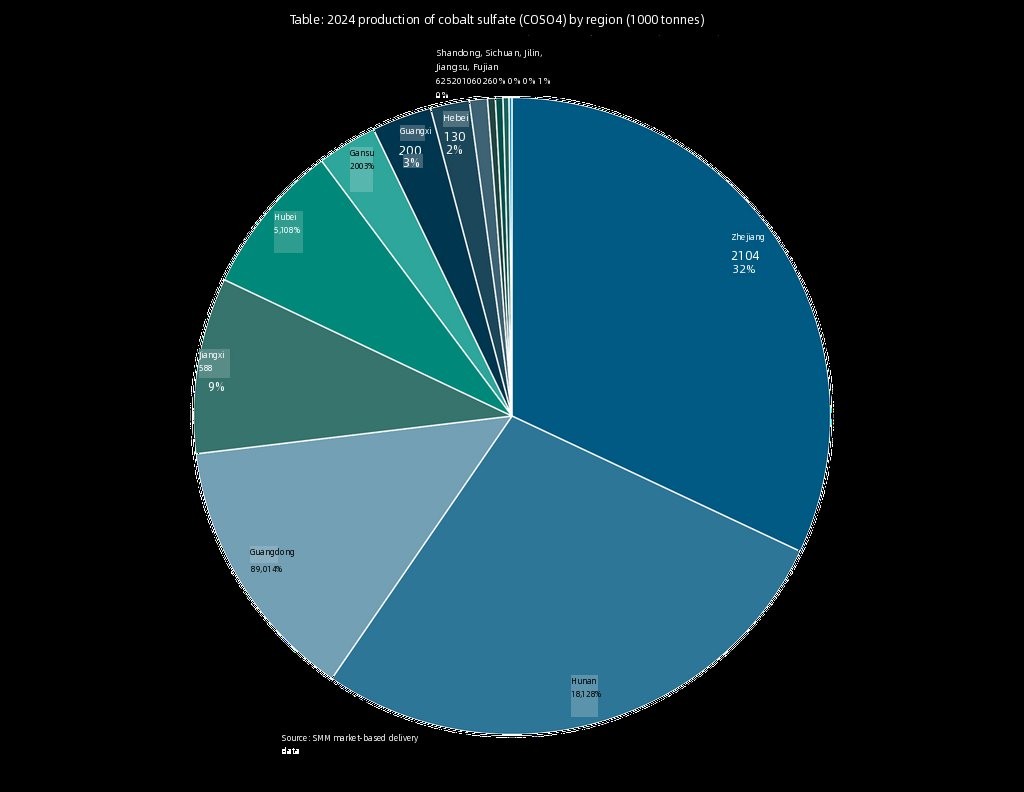

The global production of cobalt salts is mainly dominated by China, which is currently the world's largest producer and exporter of cobalt salts.

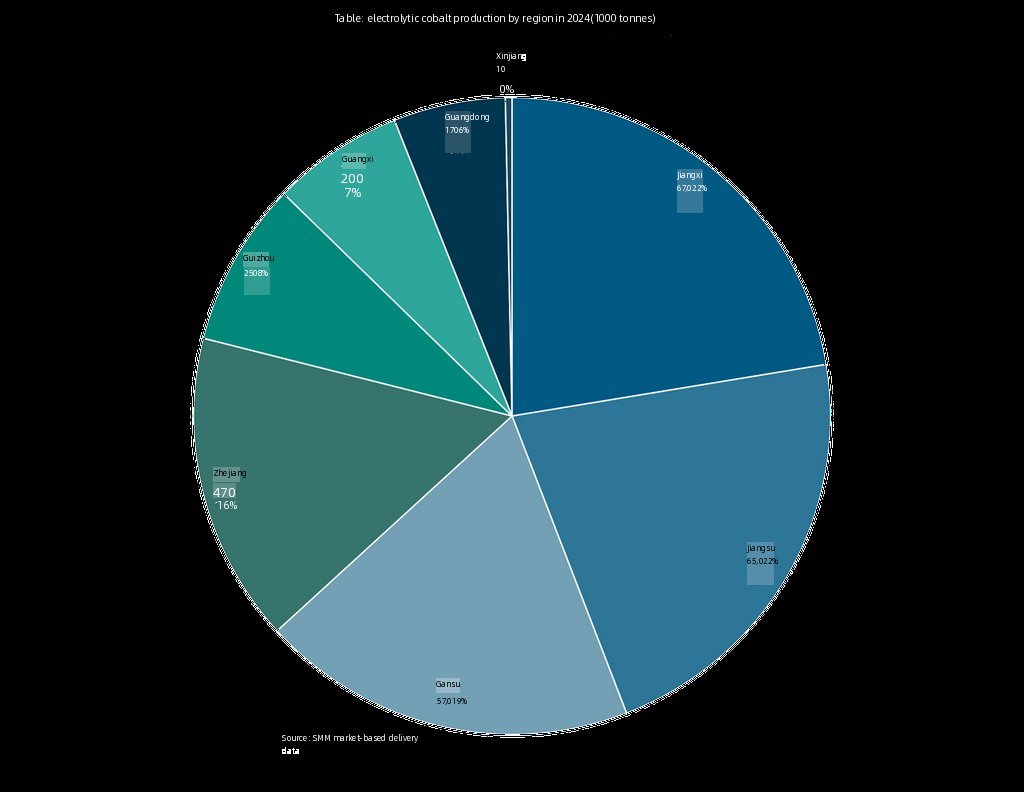

The main production areas in China include Hunan, Jiangxi, Guangxi, Jiangsu and Zhejiang, etc. Among them, Zhuzhou and Hengyang in Hunan Province are traditional cobalt salt production bases, gathering leading enterprises such as GEM and China Cobalt New Materials. Ganzhou and Yichun in Jiangxi Province have developed rapidly by relying on local resources and the lithium battery industry chain. Jiangsu and Zhejiang, on the other hand, are dominated by high-end material processing enterprises. Iii. Distribution of Downstream Demand Fields.

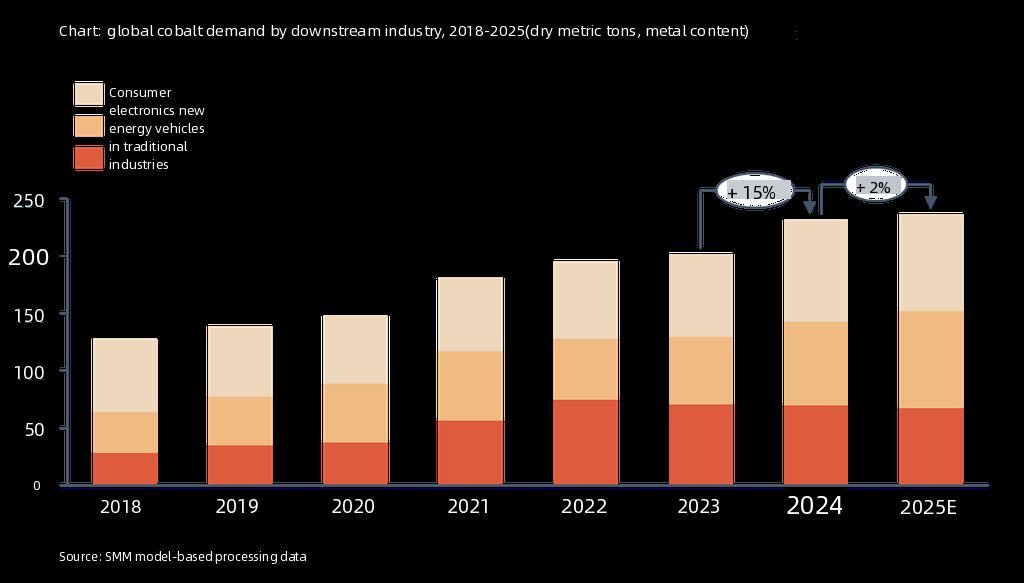

III.The global demand for cobalt mainly comes from digital, new energy vehicle (NEV) and energy storage applications in the lithium battery sector, as well as traditional industries such as superalloys, cemented carbides, catalysts, ceramic pigments, magnetic materials and organic materials. With the popularity of smart phones, the demand for cobalt in digital batteries and magnetic materials is growing at an accelerating pace, while the proportion of cobalt demand in traditional industries remains relatively stable.

With the explosive growth of the new energy vehicle market, the proportion of cobalt demand in the electric vehicle sector once rose. However, in recent years, due to the continuous impact of the lithium iron phosphate (LFP) system and the increasingly obvious trend of low cobalt in the NCM (nickel cobalt manganese) system, the proportion of cobalt demand in the electric vehicle field has shown a gradually weakening trend.

It is expected that by 2025, driven by the growth in demand in the consumer and traditional sectors, global cobalt demand will moderately increase to approximately 236,569 tons. Among them, the proportion of cobalt demand in the new energy vehicle battery industry will drop to 28%. Driven by China's national subsidy policies, the AI craze and the rapid iteration of electronic devices, the demand for cobalt in the consumer electronics industry is expected to grow, and its share may rise to 36%.

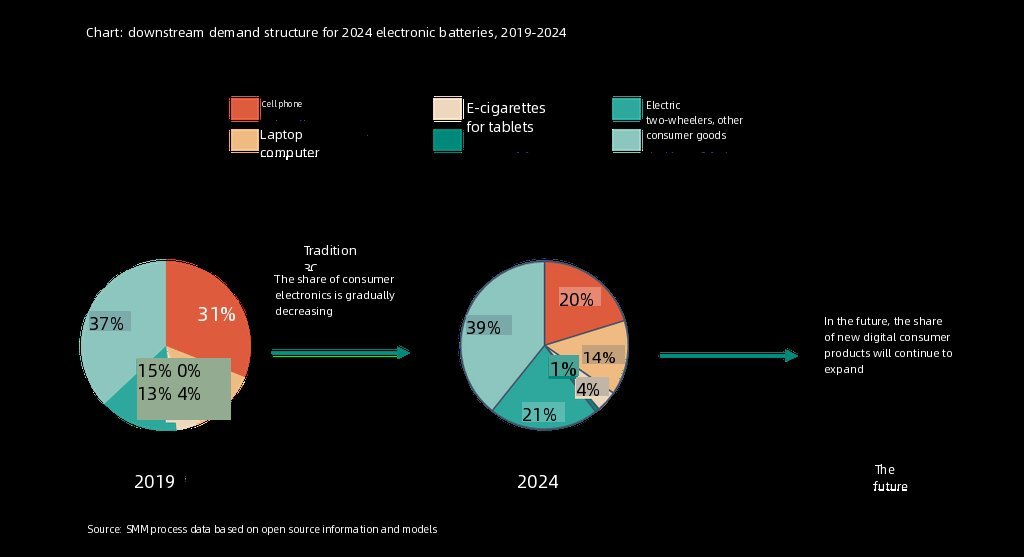

In addition to traditional 3C digital products such as mobile phones, laptops and tablets, the rapid development of emerging fields has also brought new growth points to the lithium battery market. For instance, the rapid development of power tools, electric two-wheelers, and drones, as well as the continuous emergence of new consumer electronic products such as wearable devices, smart speakers, and portable medical equipment, have further expanded the terminal application scenarios, thereby driving the growth in demand for lithium-ion batteries.

In the future, the global demand for consumer lithium batteries will be dominated by new electronic consumer products, while the proportion of traditional digital consumer fields will gradually decline. New electronic products, due to their rapid technological iteration and wide application scenarios, are expected to become the main driving force for the growth of the consumer lithium battery market. In 2024, the demand for lithium batteries in the new digital consumption sector is expected to account for 39%, and this proportion will continue to rise. Among them, the unmanned aerial vehicle (UAV) industry is in a stage of rapid development and is an important component of the new consumer electronics market. With technological advancements and the expansion of application scenarios, the unmanned aerial vehicle (UAV) market is expected to continue to grow rapidly.

In recent years, driven by the development of the military and aerospace industries, China's refined cobalt production capacity has gradually been released. Refined cobalt is mainly used in superalloys. Benefiting from the rapid development of China's aviation sector and the boost in demand from the military industry, the cobalt-based superalloy market is expected to achieve certain growth, with demand projected to rise significantly throughout 2024. In addition, refined cobalt can also be applied in the field of magnetic materials, mainly driven by the demand for samarium cobalt magnetic materials. In 2024, samarium cobalt permanent magnetic materials will mainly be used in communication base stations, high-temperature motors and other special motor fields, and the market still has certain growth potential. In the future, with the continuous expansion of the market for superalloys and magnetic materials, the consumption of cobalt is expected to increase further.

Get real-time quotes

Interested? Leave your contact details.